Yesterday, the American financial media colossus, the Wall Street Journal, published an op/ed titled, “A Short Primer on the National Debt” that was written by John Steele Gordon, “author of numerous books.” The third paragraph states the following:

The intra-governmental debt is the sum of Treasury bonds held by agencies of the federal government, principally the so-called Social Security Trust Fund. The liabilities equal the future pensions, health care, Social Security payments, etc., that are promised under current legislation.

This is unequivocally incorrect. If I were more inclined to post a “somewhat lengthy” primer, I would explain each of the items mentioned in Mr. Gordon’s statement. However, correcting the information regarding Social Security will suffice to make my point.

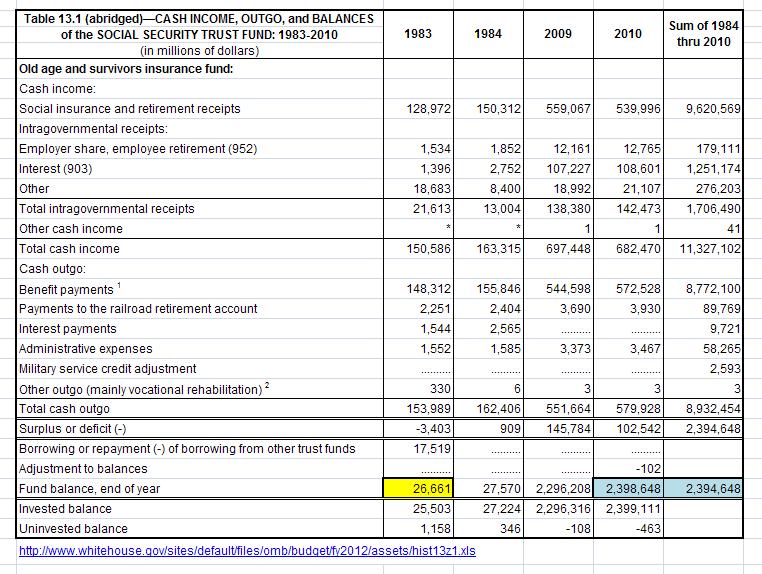

You might ask how it is that I’m so certain of having the correct interpretation of the “intragovernmental debt” figures and that Mr. Gordon doesn’t. The short answer is that a few years ago, when I was unsure of how to interpret any number of budget items, I often confirmed my understandings by assembling periodic totals from annual data. Some of the result can be seen here.

Here’s the long answer.

The Social Security Trust Fund has absolutely nothing to do with “future” payments. The Trust Fund is the running total of the excess monies collected from workers and employers but spent on whatever else Congress fancied at the time. The Treasury wrote a marker for that amount, plus interest, and then bumped-up the Trust Fund total to hide this bit of fiscal chicanery. To pay benefits, the Treasury still must 1) collect more taxes, 2) borrow more money, or 3) crank up the virtual printing presses by means of a process innocuously termed “Quantitative Easing.” The following spreadsheet illustrates the Social Security Trust Fund total-building process. (Click to enlarge image.)

Please note that the item termed “interest” comprises just about half of the Trust Fund total. You can confirm the total for the end of fiscal 2010 here or directly from the GAO here (report page 26). The totals differ by a few million which we should probably attribute to a rounding error of 4 million somewhere along the line.

But the Journal isn’t the only financial publication to step in it. That recent faux pas reminded me of one by Investors Business Daily a few years back.

In an editorial dated May 9, 2008, but no longer available on-line, IBD had the following to say:

Get Over The Gap

By INVESTOR’S BUSINESS DAILY

Posted Friday, May 09, 2008 4:20 PM PT[snip]

Journalists and pundits call the smaller deficit an “improvement,” or “good news.” It isn’t. We run a trade deficit not because we’re uncompetitive or others protect their markets, two great economic myths; we run deficits because we’re such an attractive place for investors from around the world to park their money. The deficit, in other words, is a sign of strength.

As any economist can tell you, the flip side of our trade deficit is our capital surplus, which measures foreign investment flows into and out of the U.S. When we run a trade deficit, by definition we must run a capital surplus — and vice versa.

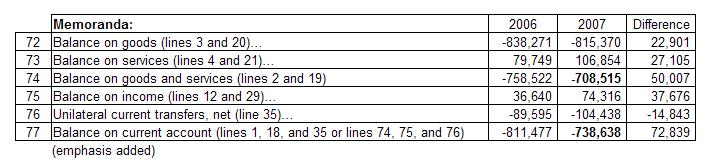

Last year, for instance, we rang up a record $708.5 billion deficit for both goods and services. But we imported the equivalent of $738.6 billion in investment capital to offset that. This was used to buy Treasury notes, bonds and stocks, and to fund real estate, plants, equipment and worker training.

I was quite stunned by this assertion because it directly contradicted my understand of what’s called the “Current Account Balance.” Of course, I just had to find out from whence came those IBD numbers, and decided to check my interpretation with the Bureau of Economic Analysis. So, I emailed the following to the boys in Washington:

* * *

May 14, 2008

TO: internationalaccounts@bea.gov

Dear Sir or Madam:

On May 9th of this year, Investor’s Business Daily (IBD) published the following editorial: http://www.ibdeditorial.com/IBDArticles.aspx?id=295225814367283

Get Over The Gap

By INVESTOR’S BUSINESS DAILY

Posted Friday, May 09, 2008 4:20 PM PT

The 8th paragraph of which reads as follows:

Last year, for instance, we rang up a record $708.5 billion deficit for both goods and services. But we imported the equivalent of $738.6 billion in investment capital to offset that. This was used to buy Treasury notes, bonds and stocks, and to fund real estate, plants, equipment and worker training.

(emphasis added)

The last few rows of data in the following BEA spreadsheet: http://wwwbeagov/newsreleases/international/transactions/2008/xls/trans407xls appear as follows (with the quarterly data removed):

My question is this: Is the IBD interpretation of the values given correct or incorrect? Since line 77 is the sum of lines 74, 75 and 76, the IBD assertion that one value offsets the other does not seem to follow. Would you please clarify?

Thank you.

Sincerely,

Dennis Sevakis

* * *

To which the BEA replied:

Dear Mr. Sevakis:

You are correct that the line in the balance of payments that best reflects our total international transactions in a given time period is the current account balance (line 77). The balance on goods and services (line 74) is only part of the balance on current account. Also, the correct comparison of the negative balance on current account with other balance of payments offsetting entries is the net inflow of capital that is referred to in the IBD article, and that net inflow is the summation of several lines in the financial account of the balance of payments. Specifically, the net flow of financial capital can be found as the sum of U.S.–owned assets abroad (line 40), foreign-owned assets in the U.S. (line 55), and financial derivatives (line 70). Please note that the entries in the financial assets section of the balance of payments represent accounting entries as credits or debits and may or may not represent actual flows of capital. They sometimes represent only the change in ownership of an asset and there might not be an actual international flow of capital cross-border. (More explanation of how the balance of payments accounting system works and what’s in the various line items can be found on the BEA website under Methodology Papers (link in the left margin on the home page), International Accounts section, “The Balance of Payments of the United States: Concepts, Data Sources, and Estimating Procedures.”

Thank you for your inquiry.

John R.

Balance of Payments Division

Bureau of Economic Analysis

Got it? My head can still spin when I try to get mind around this stuff. And having such nonsense come out of the financial press doesn’t help me or anyone else understand the critical fiscal and economic issues we currently face.

And such as this is also one of the reasons why I began attempting to figure these things out for myself. If you want a job done right . . . well, not that I don’t screw up now and again myself! :)

Ciao,

Dennis