January 16, 2011

“Protectionism” is an intendedly derogatory term used to describe the practice of one country taking measures to protect its domestic economy from encroachment by another country. Over the past couple of years or so, as a result of recent financial crises and sundry economic meltdowns, there have been frequent reminders in much of the media about how we must, at all cost, avoid protectionism and the sure-to-result “trade war.” These warnings are often accompanied by the assertion that the economic malaise of the Great Depression was severely exacerbated when the United States passed legislation raising the tariffs on many goods to prohibitive levels. Named after its Congressional sponsors, the “Smoot-Hawley” legislation of 1930 has become synonymous with short-sighted, trade-killing, depression-engendering, mindless economic tinkering.

In a video segment recently posted at the National Review Online, Peter Robinson of the Hoover Institution’s “Uncommon Knowledge” program series interviewed conservative scholar and commentator Thomas Sowell and asked him, “How much should people really worry about the balance of trade?” Sowell’s answer: “Somewhat less than you worry about being struck by lightning.” He goes on to describe the Smoot-Hawley Act as “one of the biggest disasters in the history of the country” and asserts that people do not understand the history of the Depression. Well, curiosity being the better part of discovery, I decided to do a bit of digging into the economic history of the U.S. during the Depression years in an effort to learn the impact of Smoot-Hawley on the 1930’s tanking of the American economy. [Note: Link is now directed to the Hoover Institute site. NRO link is dead. Smoot-Hawley segment starts at 19:13 into the video. Updated: 2016.07.28]

Conclusion? Smoot-Hawley and trade contraction had little impact. Here’s why.

First, let’s define what is meant by GDP or “Gross Domestic Product” as a measure of economic activity:

GDP = Government/Private Consumption + Private Investment + Government Investment + Exports – Imports

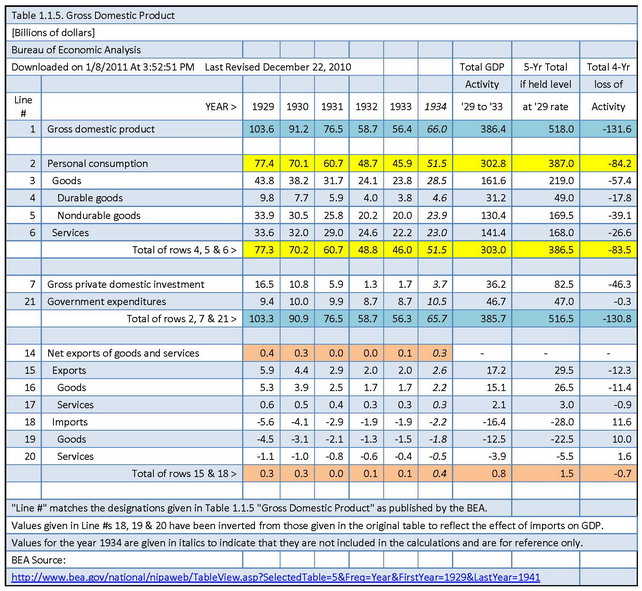

Exports and Imports include both goods and services. Imports are subtracted from the total because they do not represent domestic economic activity other than in the form of a transfer of funds out of the country. Now, the contention of the Smoot-Hawley critics is that by reducing trade between countries, the prohibitive tariffs imposed by the act created a greater, if not substantially greater, contraction of economic activity. Did this, in fact, happen? At least within the U.S.? The table given below indicates that this is not the case by quantitatively comparing trade contraction with the total loss of economic activity.

The U.S. economy began contracting in late 1929 and reached bottom in 1933. After that point economic activity began rising, but GDP did not exceed the level of 1929 until 1941, some twelve years later and on the eve of U.S. involvement in WW II. As the economy slowed for the first four years of the Great Depression, so did the level of exports and imports. But the size of any trade imbalance was quite small when compared to the level of economic contraction. The extent of the overall slowdown was so great, that over the course of those four years, one-and-a-third-years worth of economic activity at the level of 1929 was lost. This is shown in the last column of the bluish-tinted rows.

But the impact of trade was relatively small. Government expenditures remained essentially constant, but private consumption and investment plummeted. Of the $131 billion in lost economic output over the four-year period, only about $0.7 billion seems attributable to trade. This is shown as the last entry in the last row of the table. In either absolute or relative terms, the trade portion of the economic contraction of the Great Depression appears to be of little import.

Another instance, it appears, of conflating effect with cause.

You can download a copy of the following .xls spreadsheet file here.