From today’s Wall Street Journal ‘Morning Brief’:

July 27, 2011 — 9:00 a.m. EDT

Boehner Plan Faces Rebellion

House Speaker John Boehner, facing a rebellion among conservative Republicans and questions about the amount of spending cuts in his plan for raising the borrowing limit, abruptly postponed a vote on the measure scheduled for Wednesday.

The delay added further confusion less than a week before a possible government default. It was a setback for GOP leaders who had promoted Mr. Boehner’s plan as the best way to raise the debt ceiling while cutting the deficit.

The jolt came late Tuesday, when the Congressional Budget Office said the plan, which was intended to initially cut $1.2 trillion in spending over 10 years while raising the debt limit by $900 billion, would in fact cut only $850 billion from the latest spending projections.

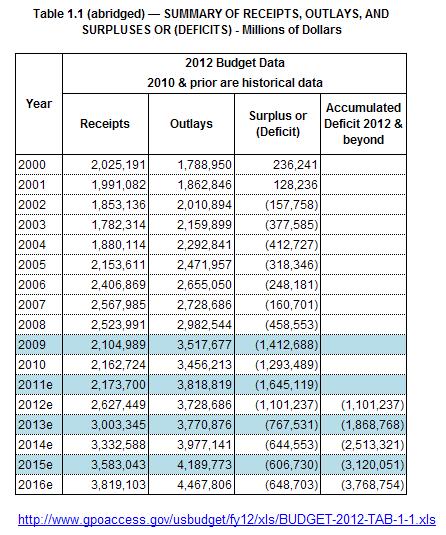

I don’t have access to the up-to-the-minute ‘spending projections’, so let’s take a peek at what the fy2012 White House budget tells us:

Or, you can get the table directly from the OMB here.

Guess those pesky, recalcitrant, budget-bashing Tea Partiers see things the same way I do. How’s cutting even $1.2 trillion out of the budget over 10 years, i.e., $120 billion per year or thereabouts, do much to reduce deficits projected to total $3.77 trillion over the next 5 years?

And that’s only if the revenue projections hold!

Note that since topping out in fy2007, receipts have fallen and remained relatively flat at an average of around $2.15 trillion. The the forecast for fy2012 shows receipts jumping back up by about $450 billion to a level higher than the 2007 peak.

Think that’s realistic, Mr. Boehner? I don’t.

That’s why you have a Tea Party rebellion on your hands. They intend to keep their promises to their constituents. That’s why they’re called “Representatives.”