That implies, of course, a negative deficit, as one might say in gov’ment speak. For most people it makes no sense to borrow more money to pay back money and then not pay it back. But that’s what countries all over the planet have been doing in ever increasing amounts with accelerating frequency. And for the United States that approach will probably mean a higher average interest rate since our national credit rating seems likely to tank in the near future. Or does it? Not my department. I’m terrible at predictions. After watching the Beatles on the Ed Sullivan show I prognosticated they’d never be that big.

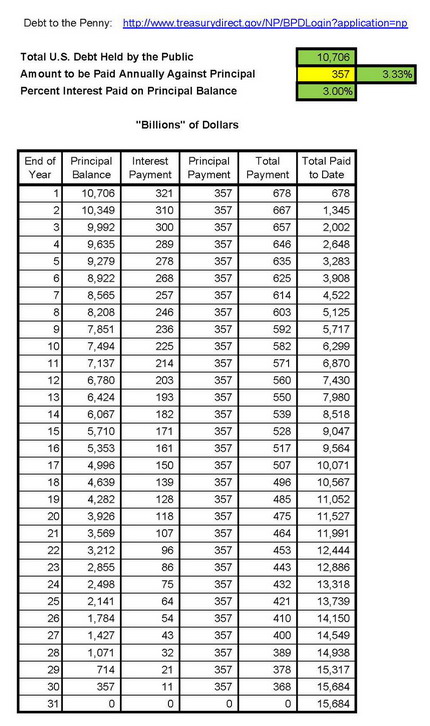

What interest rate does the U.S. pay on its debt? That’s available here at treasurydirect.gov. The rate given is a composite of those paid on various types of securities with varying maturities and rates. For June of 2011 the figure was 2.957%. Just for the heck of it we’ll use 3%.

Note that there is no mention of the aforementioned “intragovernmental” debt anywhere to be seen on this page. That’s because interest on phantom debt is ethereal and difficult to display visually. Though much ado of said numbers is often made while bureaucratically cooking the intragovernmental balance sheets.

Also note that the rates given do not include any of the inflation adjusted securities as is footnoted. So, our 3% is already an underestimate. If inflation accelerates and/or the Dollar drops more, essentially two sides of the same coin, that underestimation will increase. Oh, well, but let’s press on while retaining a smidgen of trust in the Treasury number for June.

We must also decide on a public debt total to use in our calculations. I’ll go out on a limb and extrapolate the historical increase in the public debt since the end of the last fiscal year to come up with a total for FY2011 which ends September 30th. Let’s see, that should be ((($9.742 – $9.017) x 1.33) + $9.742) = $10.706 trillion, approximately. Plug that into our simple interest debt reduction calculator using a standard repayment term of 30-years and we have:  This result is valid if, and only if:

This result is valid if, and only if:

- No additional Public Debt is incurred in FY2012 and beyond.

- The United States unilaterally restructures its Public Debt as indicated.

And still, the first year payment is $678 billion!

Obama isn’t the only one who got us to this point. The Bush tax cuts and budget deficits contributed mightily to the deficit explosion, while the American public did its part by pumping the housing bubble with speculative “Liar Loans” that were an integral part of the financial meltdown of 2008. The resulting reduction in tax revenue collections has substantially exacerbated the deficit problem.

More on that next time.

Ciao, Dennis