That is not as easy a question to answer as I have been thinking. While doing more exploring of the federal web sites, I came across a page at the GAO (Government Accountability Office) that informs as follows:

Measuring the Deficit: Cash vs. Accrual

In recent years, public debates and media reports have focused on the country’s financial position. This debate has historically focused on the budget deficit, also called the “cash deficit,” which reached a record of $1.4 trillion in fiscal year 2009. Because the budget deficit is primarily measured on a cash basis, we call it the cash deficit. However, another measure referred to as the accrual deficit also provides a useful perspective on the federal government’s financial condition. While the cash deficit closely approximates the federal government’s annual borrowing needs, the accrual deficit provides more information on the longer-term implications of the government’s annual operations.

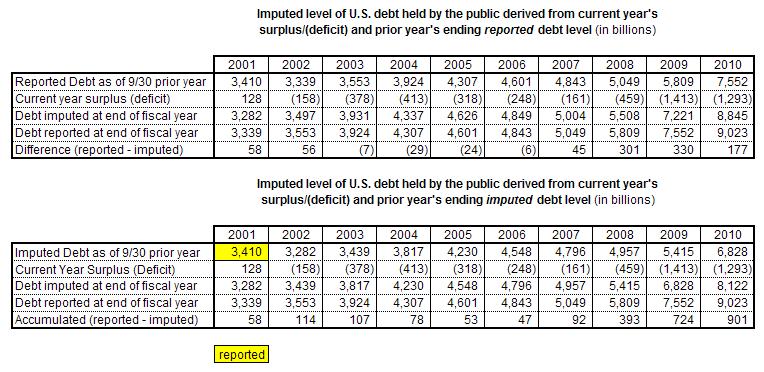

Okay. That’s clear enough. But when I try to correlate the level of publicly held debt with the size of the deficits, I come up with the following (click to enlarge):

What’s wrong? As you can see, over the last ten years we have accumulated about $900 billion in publicly held debt over and above the accumulated deficits. If the “budget deficit” or “cash deficit” closely approximates the federal government’s annual borrowing needs, why is there a nearly $1 trillion discrepancy? I’m not an accountant, and I may be off base here, but in my mind something doesn’t seem to compute. And I don’t believe it has anything to do with recent Quantitative Easing. Those Treasuries end up in the Fed’s hands and I don’t think that counts as “Debt Held by the Public.”

Mr. Boehner? Mr. Reid? Mr. Frank? Mr. Sarbanes? Mr. Oxley? Mr. President?

Anybody?