Time for another stab at the Free Trade Boogeyman … and the Wall Street Journal.

Here are some of the thing that the Journal had to say about presidential candidate Mitt Romney in response to a recent Romney ad swiping at our trade nemesis China:

• Americans have heard similar trade themes before—from Walter Mondale, Dick Gephardt, Bob Kerrey, John Kerry, Pat Buchanan and Ross Perot, among others. What they all have in common is that they were candidates who never became President.

• As a former businessman, Mr. Romney surely knows that cheaper Chinese imports create jobs in the U.S. up and down the merchandise and services value chain.

• Mr. Romney’s larger mistake is that this ad conveys an economic pessimism that undermines his political case that he can deliver a better future for American workers. If the only way to revive American manufacturing is to steal jobs back from China, our future can’t be very bright.

Point one seems pointless. Other than Ross Perot, none of those mentioned were candidates with a business background nor would they have been considered fonts of economic wisdom. And was their position on trade a pivotal factor in their failure to be elected? Not likely.

Point two is true but makes no mention of the flip side: the loss of smaller retail outlets and distributors in the U.S. to competition from the Big Box stores such as Walmart. There may have actually been an overall net loss of such jobs. Also interesting is that Home Depot and Best Buy have closed or will close their China stores because their business models just don’t work there. Guess honorable Mother and Father will be staying in business.

But the crux our trade deficit issue with China, not to mention energy imports, is nicely sidestepped by number three. Bringing jobs back from China would be stealing them? Couldn’t you also say that the multi-national corporations stole the jobs from Americans when they invested in China rather than the U.S. and consequently “off-shored” those jobs? Or am I beginning to sound like a union organizer?

Globalization is not a “natural” phenomenon in the sense that it was self-starting and self-perpetuating. It was and is a purposeful venture on the part of U.S. and foreign multinationals to expand their markets, sales and profitability. Back in 1980, with the exception of certain natural resources, the United States could have managed to get along while enjoying a decent standard of living with very little trade with outside world. That situation would have not been optimal, and competition from overseas would not have led to the improvement in quality that is so obvious in such products as automobiles. But we had the “in-house” skills, knowledge and capacity to produce not only finished goods but also the machinery and tooling required to produce them. Today, much of that capacity and skilled labor pool is gone. Disappeared. Even if we wanted to, we could never duplicate Herculean effort that transformed Detroit into the “Arsenal of Democracy” during WW II. We even buy much of our military hardware from overseas including the Chinese who, by the way, have been known send us counterfeit electronic chips that ended up in U.S. fighter aircraft. ![]() Today, along with any number of other products, there isn’t a single TV or light bulb produced in the U.S. But, I don’t want you to get the idea that U.S. manufacturers willy-nilly shipped millions of jobs overseas just to save a few bucks on labor.

Today, along with any number of other products, there isn’t a single TV or light bulb produced in the U.S. But, I don’t want you to get the idea that U.S. manufacturers willy-nilly shipped millions of jobs overseas just to save a few bucks on labor.

The cost of doing business in the United States has been pushed ever upward for a number reasons beside direct labor expense. Of course, there’s been the monumental increase in the cost of medical care. There’s also been increases in payroll taxes. Property taxes. Then there’s cost of dealing with environmental, equal employment opportunity, disability, personal injury, and product liability issues. Not to mention the myriad of regulations you can go to jail for but don’t even know exist. Why anyone would even want to be in a manufacturing business in the U.S. seems a mystery to me. If many of those issues can be whisked aside with the flick of a trip overseas, well, why not? My point being that social, environmental, and health legislation, along with over-regulation and taxation, have consequences often foreseen but ignored. Corporations, being even less inclined than individuals to beat their heads against walls, move overseas where many of these barriers don’t exist. And if in the name of free trade they can bring their products back into the country with little or no tariff, well, they’re even willing to hand over most, if not all, of their technology for the privilege of setting up shop in the Middle Kingdom. ![]()

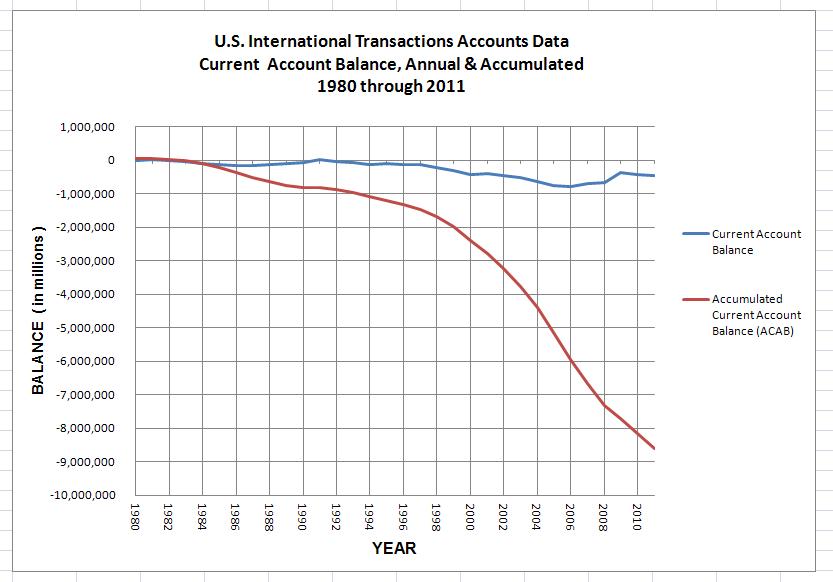

So, what’s the proverbial bottom line? It’s the following chart that illustrates how much we’ve given away by borrowing to maintain our lifestyle rather than work for it. Over the past thirty-plus years, it adds up to nearly nine trillion. I cannot come away from looking at this graph convinced that our trade and energy “policies” since 1980 have been to our long-term benefit. And any concern over tariffs and the Smoot-Hawley canard is nonsense. ![]()

The numbers and sources behind the chart, including data on foreign-held U.S. debt, is given in the following spreadsheet:

And whom do you think we should blame for all this? Certainly not the Chinese.

Ciao,

Dennis