Yesterday, the New York Times had this to say about S&P’s downgrading of U.S. debt:

Amid Criticism on Downgrade of U.S., S.&P. Fires Back

The day after Standard & Poor’s took the unprecedented step of stripping the United States government of its top credit rating, the ratings agency offered a full-throated defense of its decision, calling the bitter stand-off between President Obama and Congress over raising the debt ceiling a “debacle.” It warned that further downgrades may lie ahead.

[snip]

Officials at the White House and Treasury criticized S.& P.’s move as based on faulty budget accounting that did not factor in the just-enacted deal for increasing the debt limit.

But we can do that! Factor-in, that is.

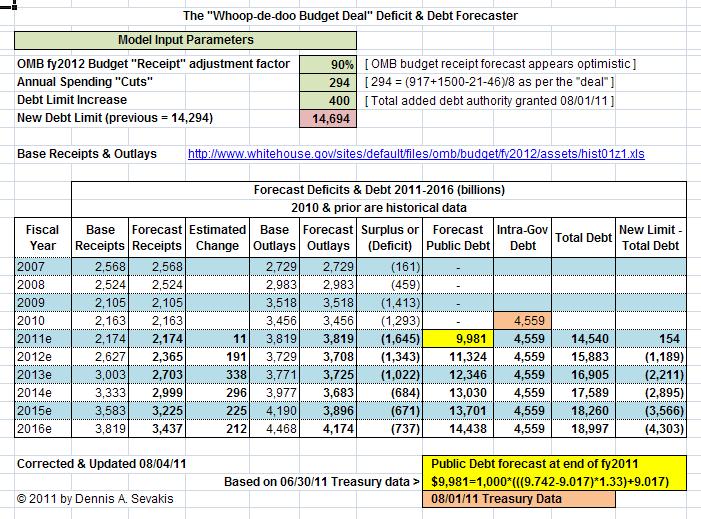

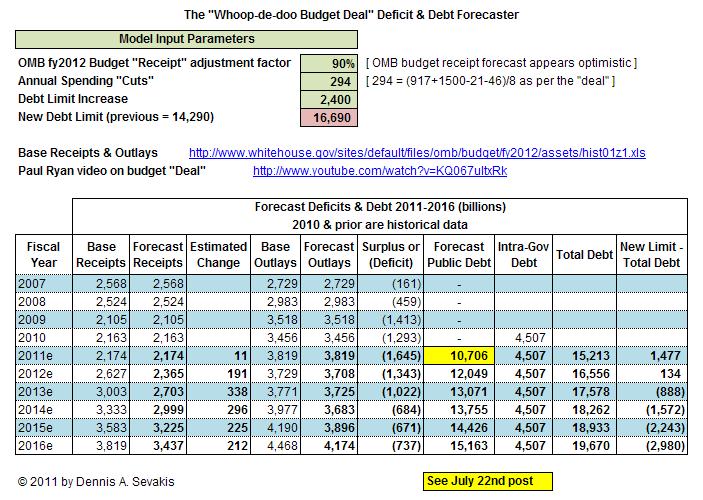

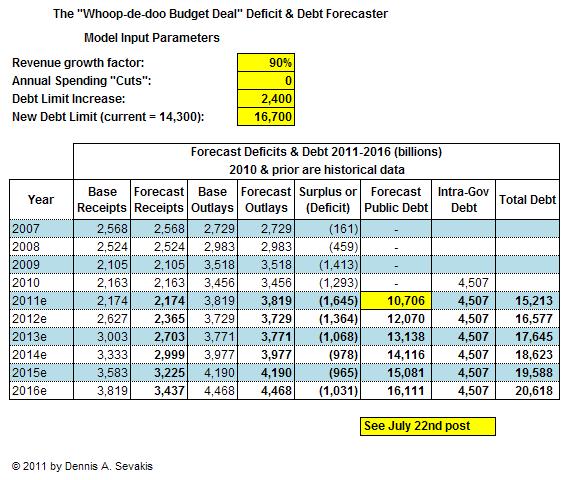

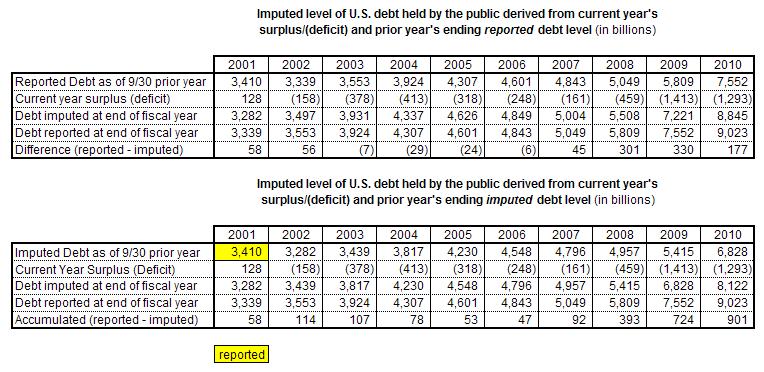

Here’s the latest upgrade/update to the deficit and debt calculator:

which is available here for downloading and personal tracking of OUR debt.

Well, that sure makes a difference. . .NOT! Before any of the “big” cuts factor-in, we’ll be another $2.50T in the hole. S&P is correct in saying that Congress has basically done nothing to reduce America’s deficits and borrowing requirements. And when you keep on going deeper into debt without an increased capacity to pay, your credit rating goes down. That’s the way it’s supposed to work, you “Officials” at the White House and Treasury, you!

By the way, the “Daily Burn Rate” is derived by dividing the change in Public Debt since the end of the last fiscal year by the number of days since the close of that fiscal year. The Public Debt for the end of fiscal 2011 is the arrived at by adding the burn-rate times days-to-go to the Treasury number for the Public Debt on the date under consideration.

This September, while you’re following the Pennant races, I’ll be following the Debt Race. Oh well, such is the price of a misspent adulthood.

But back to the issue at hand.

What does the “World” think of all this? Let’s ask Brian Williams to enlighten us:

Visit msnbc.com for breaking news, world news, and news about the economy

Did that help?

And, how do Americans view the responsiveness of those charged with our governance? Here’s a recent survey from Rasmussen:

New Low: 17% Say U.S. Government Has Consent of the Governed

Sunday, August 07, 2011

Fewer voters than ever feel the federal government has the consent of the governed.

A new Rasmussen Reports national telephone survey finds that just 17% of Likely U.S. Voters think the federal government today has the consent of the governed. Sixty-nine percent (69%) believe the government does not have that consent. Fourteen percent (14%) are undecided. (To see survey question wording, click here.)

The number of voters who feel the government has the consent of the governed – a foundational principle, contained in the Declaration of Independence – is down from 23% in early May and has fallen to its lowest level measured yet.

This is getting very ugly, folks. Maybe even 1860-ish ugly.

For those of you interested in doing some Social Security and Medicare funding shortfall forecasting, I have some new spreadsheets available for said purpose:

- Social Security OASI & DI, Old-Age & Survivors Insurance and Disability Insurance, is here.

- Medicare HI, Part A Hospitalization Insurance, is here.

- Medicare SHI, Parts B & D Supplemental Health Insurance is here.

As time goes on I’ll get more reference and explanatory documentation added to those.

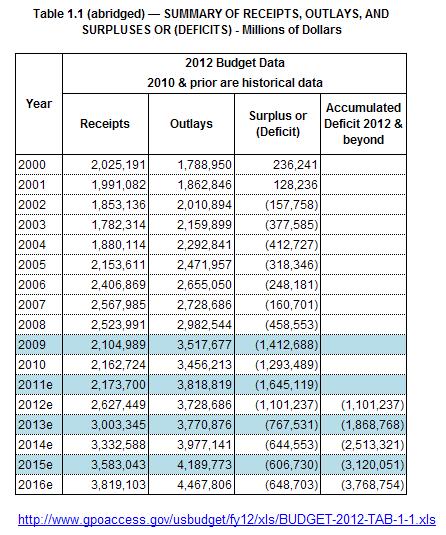

For your convenience, once again here are the links to the 2012 OMB budget spreadsheets:

- 2012 Budget Outlays with subtotals & off-budget listed separately

- 2012 Budget Receipts with subtotals & off-budget listed separately

That should be enough to keep you busy ’til the end of the fiscal year! :)

Ciao, Dennis